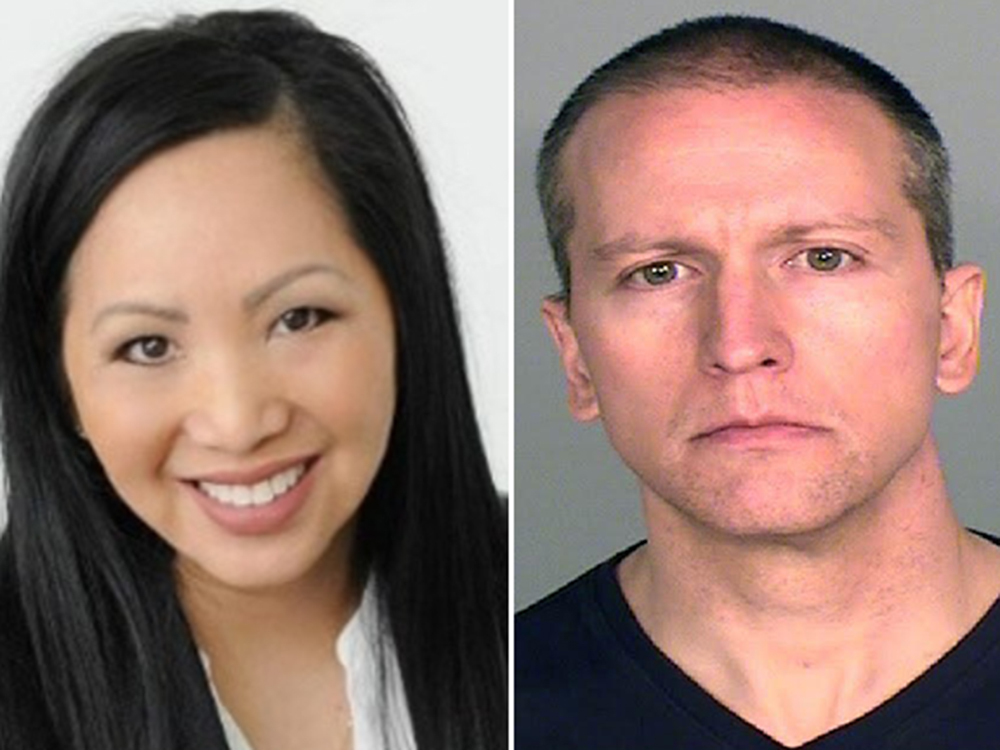

*Derek Chauvin, the former Minneapolis police officer who was charged in George Floyd’s death, is now facing nine felony income-tax charges, along with his estranged wife.

Chauvin and Kellie — who filed for divorce in June — have been charged with “multiple tax-related felonies,” according to a press release from the Washington County District Attorney.

Derek and Kellie did not file income tax returns in the state from 2016 to 2019, in addition to filing fraudulent returns from 2014 to 2019, the press release said.

Each count carries a maximum five-year prison sentence and a fine of $10,000, CNN reports.

OTHER NEWS YOU MIGHT HAVE MISSED: Anti-Trump GOPers Drop Ad Showing Every Step of Trump’s COVID Denial as Cases Rise (Watch)

The Chauvins were allegedly aware “of their obligation to file state income tax returns due to their filings in previous years and from multiple correspondences sent in 2019 by the department regarding their missing 2016 individual income tax return,” the press release stated.

Chauvin worked as a Minneapolis police officer during that time as well as working in security at several local Minneapolis businesses, according to the court records. Kellie was a realtor and photographer.

Chauvin is currently in custody after being charged in June with second-degree unintentional murder of George Floyd on Memorial Day. Floyd’s death was captured on camera and sparked national protests overs police brutality.

Derek’s bail was set at $1.25 million.

Kellie is reportedly not in custody for her tax crimes.

Floyd’s family has sued the city of Minneapolis and the four officers involved in his death.

The suit notes the “police culture of excessive force, racism and impunity,” a press release obtained by PEOPLE said.

It’s worth noting that Chauvin murdered Floyd over an allegedly fraudulent $20 bill. Meanwhile, he himself underreported $464,433 in income and owes $37,868 in fraud penalties, interest, and fees.

We Publish News 24/7. Don’t Miss A Story. Click HERE to SUBSCRIBE to Our Newsletter Now!