*The COVID-19 crisis has been especially devastating for The Trump Organization, which is reportedly looking to postpone some of its financial obligations during this pandemic.

According to a New York Times report, representatives for the president’s family business are having discussions with Deutsche Bank AG about delaying some loan payments as the global coronavirus outbreak disrupts the economy.

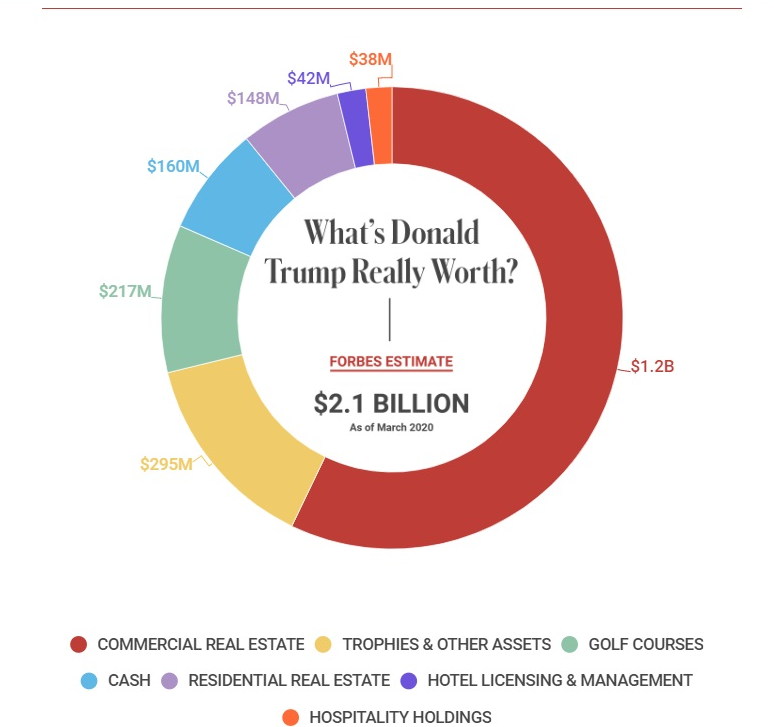

Forbes has outlined just how much the coronavirus has affected the president’s fortune, analyzing his commercial real estate holdings as well as how changes in the price of stocks have affected his business entities.

via forbes.com:

The core of Trump’s empire, which the president still owns but his sons Eric and Don Jr. run on a day-to-day basis, remains tied up in commercial real estate holdings. Before the coronavirus disrupted everything, those properties were worth an estimated $1.9 billion after deducting debt. By March 18, 2020, that was down to an estimated $1.2 billion. Part of the problem: Trump owns 125,000 square feet of retail real estate near Fifth Avenue in Manhattan, typically a bustling retail corridor. Today, it’s a virtual ghost town.

Check out below how the publication further breaks down why Donald Trump, who was valued at $3.1 billion a month ago, is now worth $2.1 billion.

OTHER NEWS YOU MIGHT HAVE MISSED: Sherri L. Smith: Laptop Mag Editor-in-Chief on Reporting & Representation in Consumer Tech Media

COMMERCIAL REAL ESTATE

Retail and office space in New York and San Francisco

In addition to commercial holdings, the president owns more than 500 residential units across the country. The shutdown happened so quickly that there is still not much data on home sales, making it hard to determine what anything is worth. “Purchasers are unlikely to make their largest financial investment of their life through a virtual tour,” says Jonathan Miller, a New York residential real estate expert. Public markets, however, point to declining values. Stock prices of five apartment owners dropped by more than one third, on average, from March 1, 2020, to March 18, 2020.

RESIDENTIAL REAL ESTATE

More than 500 units in five states

The situation is even more dire for Trump’s hospitality holdings. The Trump Organization had been trying to sell its hotel in Washington, D.C., but those plans are now on hold. The president’s companies have shed more than 550 employees, according to the Washington Post.

HOSPITALITY HOLDINGS

Hotel in Washington, D.C., and resort in Miami

During a White House press conference in March, President Trump responded to a question about the effect of the coronavirus on his business: “I’m very underlevered and everything, so that’s good.” Not necessarily at the D.C. hotel or the president’s Miami golf resort, however. Deutsche Bank handed Trump $170 million to remodel the Trump International Hotel and another $125 million for Trump National Doral in Miami, which produced $9.7 million of 2018 profit (measured as earnings before interest, taxes, depreciation and amortization). “Sounds pretty highly levered,” says hospitality analyst Dan Wasiolek.

HOTEL LICENSING AND MANAGEMENT

Branding and management deals in Hawaii, Uruguay, India and elsewhere

The impact on Trump’s golf course portfolio depends largely on how long coronavirus keeps the economy shuttered. The good news, for golf investors, is that it’s easy to socially distance on the links. The bad news is that pricey clubs don’t tend to do well in recessions. “The first thing that gets cut out of the diet is the golf budget,” says Jeff Davis, managing director of golf brokerage firm Fairway Advisors. The value of Trump’s business, worth an estimated $271 million or so at the start of March, dropped an estimated 20%.

GOLF COURSES

Ten U.S. golf clubs, three European properties

Mar-a-Lago, the president’s most famous club, may be holding up better than the rest of his clubs, even though it has been in the news for hosting people who later tested positive for coronavirus. That’s because Mar-a-Lago is valued more like a billionaire’s trophy than an operating business, which seems to shield the impact of the current downturn.

TROPHIES & OTHER PROPERTIES

Mar-a-Lago, Trump Tower penthouse, Trump Winery and other assets

The best-performing part of the president’s portfolio is his cash pile. The president got rid of his stock holdings long ago and now keeps an estimated $160 million safely in cash accounts. That looked like a bad investment over the last few years, as the stock market soared and the president missed out on the gains. But today, a flat return is a great return.

Read the full Forbes report here.

We Publish News 24/7. Don’t Miss A Story. Click HERE to SUBSCRIBE to Our Newsletter Now!